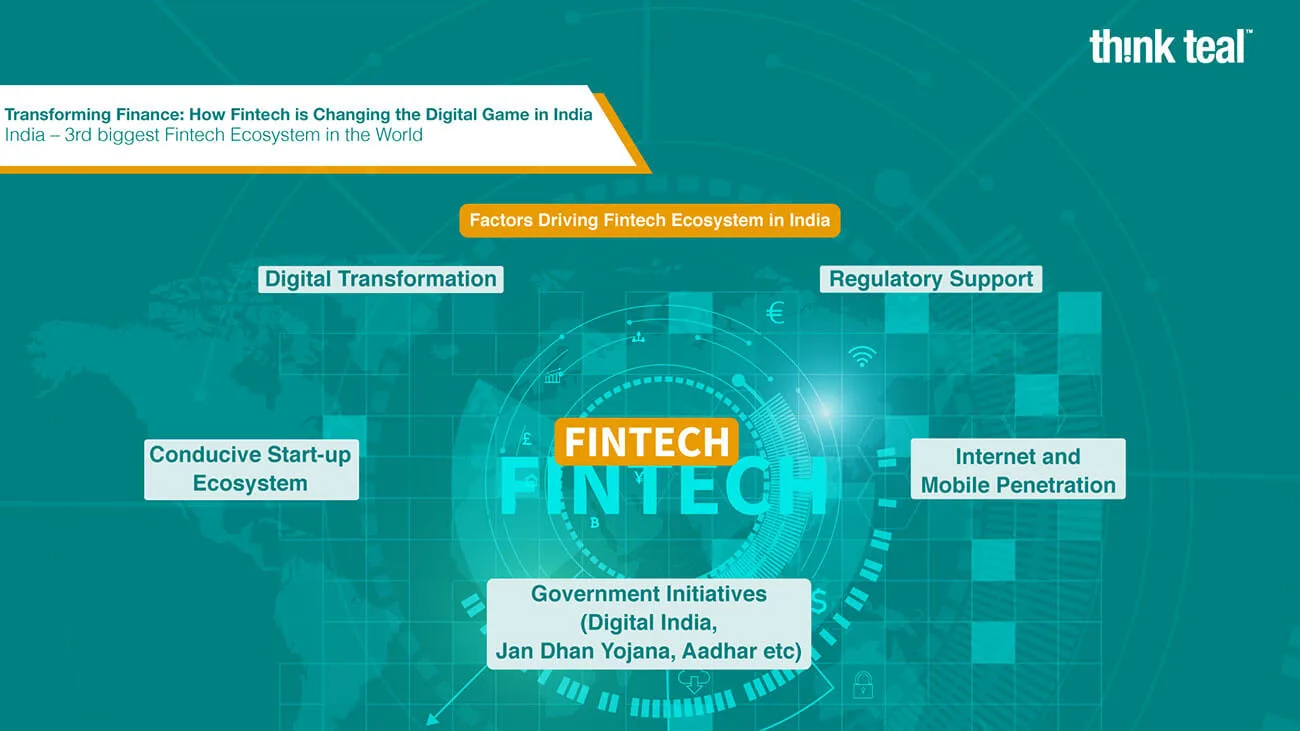

Transforming Finance: How Fintech is Changing the Digital Game in India

India – 3rd biggest Fintech Ecosystem in the World

- India is set to be a global Fintech hub, projecting a $1.5 trillion market by 2025.

- The country accounts for 40% of global digital payments.

- In 6 years (2016-2022), fintech funding deals have grown by almost 82%.

- Fintech start-ups have doubled in the last five years to reach 9000 as of 2023.

- Government of India estimates the digital economy to contribute to more than 20% by 2026 (from the current 10%), and fintech is playing a significant role here.

- Traditional banks are also playing a crucial role in fintech ecosystem growth in India.

- Fintech companies provide “technology know-how”, and traditional banks provide “banking domain knowledge”, which helps in improving the banking ecosystem.

- Neobanks built on fintech are leading the banking innovation in India and are playing a vital role in the SME sector.

- SBI, India’s largest bank, has started the Fintech Innovation Incubation Program (FIIP) to nurture innovative fintech start-ups.

- YONO 2.0, SBIs digital banking platform, has plans to onboard 75-100 fintech, making it India’s biggest fintech engagement program.

The push by the government for the financial inclusion of every citizen is driving banking innovation in India. At the forefront of this innovation are fintech companies that are elevating technology to create new financial products and, at the same time, enhance the overall banking experience of every individual in the country.